|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

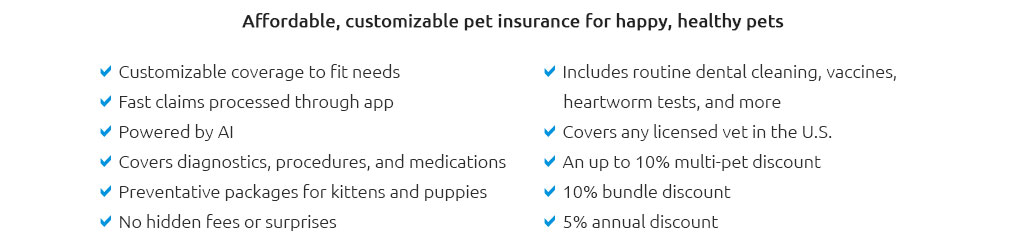

Understanding the Pet Insurance Gap Only: Bridging Coverage GapsIntroduction to Pet Insurance GapsPet insurance is a crucial safety net for many pet owners. However, understanding the nuances of coverage, including potential gaps, is essential. The term 'pet insurance gap only' refers to the coverage gaps that might exist in standard pet insurance policies. Common Gaps in Pet Insurance PoliciesPre-existing ConditionsOne of the most significant gaps involves pre-existing conditions. Many insurers do not cover these, leaving pet owners financially responsible. Specific Illness CoveragePolicies might exclude specific illnesses such as pet insurance for hip dysplasia, requiring additional riders or separate policies. Addressing Coverage GapsTo effectively manage and bridge these gaps, pet owners should:

Evaluating Your Pet Insurance NeedsIt's essential to evaluate the specific needs of your pet. For instance, if you rent your home, you might consider policies that offer pet insurance for house rental to protect against potential liabilities. FAQWhat is a pet insurance gap?A pet insurance gap refers to aspects of pet care and medical needs that a policy does not cover, potentially leaving the pet owner to cover those expenses out-of-pocket. How can I identify gaps in my pet insurance policy?Carefully reviewing the policy documents, discussing with the insurance provider, and comparing with other policies can help identify coverage gaps. https://gaponly.com.au/

Only GapOnly ready policies process your pet insurance claim while you're still at the vet. You simply pay the gap (the difference between the vet's invoice ... https://www.forbes.com/advisor/au/pet-insurance/gaponly-pet-insurance-payments-explained/

GapOnly Pet Insurance means you only have to pay the gap at the vet: that being the difference between your pet's vet bill and the claim benefit. https://gaponly.com.au/gaponly-insurance-partners/

only), administered by PetSure and promoted and distributed through their ...

|